Will suspension of Turkish organic certifier mean the end of suspicious corn and soybean imports from the Black Sea region?

By vast

Published: May 27, 2019

Category: Fighting Organic Fraud, The Organic & Non-GMO Report Newsletter

By Ryan Koory, senior economist, Mercaris

On May 13, 2019 the US Department of Agriculture National Organics Program (USDA NOP) released an alert notifying the industry that all organic certifications previously issued by the Control Union Certifications Turkey office (CUC – Turkey) will be effectively terminated within 60 days. The list of operations impacted by this announcement includes most of the large exporters who operate in the Black Sea region including Diasub FZE, Ekoturka, and Tiryaki Agro. The operations impacted have 60 days to resubmit an application for organic certification, or face a total surrender of their organic certification status. Those that do choose to re-apply for certification must do so through a new certifier, and with increased information disclosure and control requirements. The full notice of suspension and additional details can be found at the USDA NOP.

On the face of it, this announcement appears to be a win for U.S. organic producers who have long pushed for increased controls and oversite of organic imports which have been suspiciously eyed as being potentially fraudulent. As justification for this move, the USDA NOP sited a history of poor record-keeping by the CUC-Turkey, as well as clear evidence of fraud including an example of an organic producer whose yields exceeded the national average by 300 percent. But, despite the significance of this announce, the impact may prove to be more symbolic than meaningful as far as U.S. organic imports are concerned.

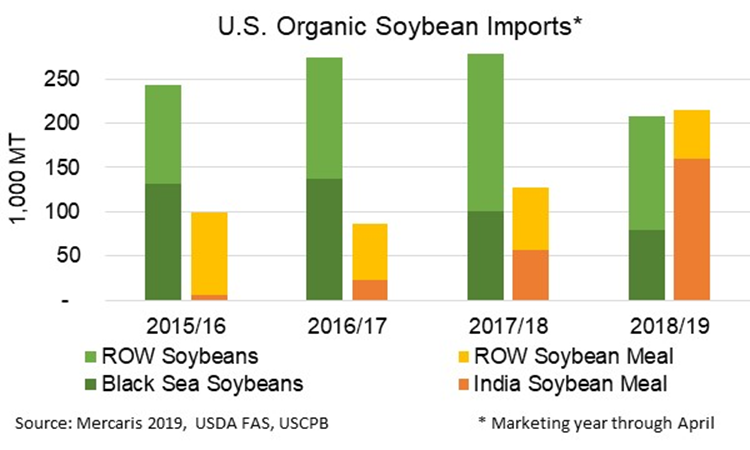

Reviewing U.S. import data over the past year, it is clear that the role of the Black Sea region has declined significantly. Looking at organic soybean imports it appears they peaked over 2017/18 and have been in decline since. Imports from the Black Sea were already under pressure following a 2017 Washington Post article that highlighted the existence of fraudulent imports originating from the region. Comparing historical import volumes, whole organic soybean imports from the Black Sea declined 26 percent year-over-year (y/y) through the first 8 months of 2017/18. Continuing this trend, Mercaris estimates organic soybean imports from the Black Sea declined another 21 percent over the first 8 months of 2018/19.

In addition to the pressures of bad press, imports of organic soybeans overall have been under pressure from a surge in organic soybean meal imports. Organic soybean meal imports from India have experienced particularly rapid growth this year, expanding 183 percent over 2017/18. Mercaris estimates U.S. organic soybean meal imports from India surpassed 159,000 metric tons (MT) over the first 8 months of 2018/19, more than double the volume of organic soybeans imported from the Black Sea during this time period. So, for U.S. organic soybean producers the USDA NOP announcement may bring some relief from foreign market competition. However, the overall impact of the suspension plays perfectly along with trends already well established in U.S. imports, and in reality, will likely do little to impact U.S. organic soybean supplies or demand.

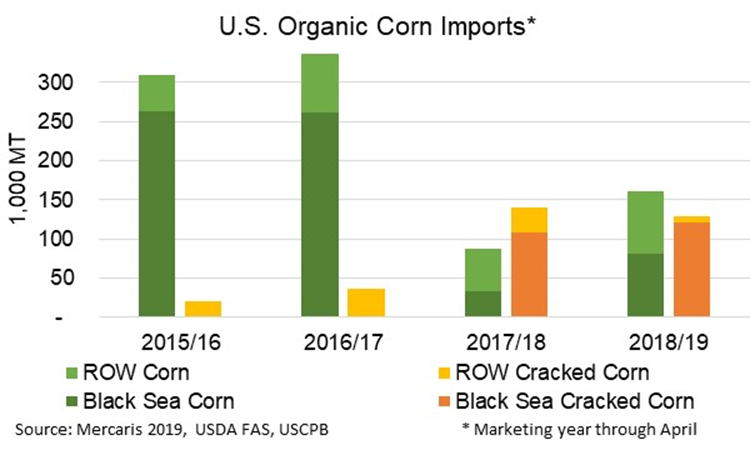

The certification suspension will likely be more impactful for U.S. organic corn imports, as the U.S. has remained more reliant on supplies from the Black Sea. For comparison, over the first 8 months of 2017/18, 63 percent of U.S. combined organic whole and cracked corn imports were sourced from the Black Sea, compared to only 36 percent of organic soybean supplies. Additionally, the volume of imports from the Black Sea has grown to nearly 202,500 MT over the first 8 months of this marketing year, up 42 percent y/y. That said, organic corn imports remain down overall from their peak in 2016/17. Also, as a share of U.S. supplies, imports account for a smaller portion of organic corn compared to organic soybeans. Mercaris estimates imports accounted for 27 percent of U.S. corn supplies over 2017/18, compared to 76 percent of organic soybean supplies.

Altogether, the exclusion of Black Sea organic corn supplies will likely tighten the U.S. market to some degree. However, the overall impact will be muted by the less substantial role of imports in the organic corn market overall.

No matter how much impact these suspensions have over the near-term, this announcement marks important progress in the ongoing effort to protect the integrity of U.S. organic markets. As the impact of this announcement ripples throughout the global supply chain, it will be important to observe whether the Black Sea will re-establish itself, if purchasers turn more towards domestic producers, or if global supply chains will simply shift in response. Regardless of the outcome, continued vigilance of both domestic and foreign organic markets will be required to preserve the strength and integrity of U.S. organic commodity markets.

Source: Mercaris.com