Current trends and challenges for global organic agriculture

Published: February 19, 2024

Category: Organic News

In February 2024, the 25th edition of “The World of Organic Agriculture” will be launched by FiBL (Research Institute of Organic Agriculture) and IFOAM – Organics International. This comprehensive report has provided valuable insights into the global organic agriculture landscape for decades, including data tables, country and continent reports, market analysis, standards, and policy support. With over 200 data and information providers contributing to this report, it is a crucial resource for stakeholders in the organic farming industry.

This article explores key findings and challenges highlighted in the most recent report (2021 data) and some 2022 and 2023 trends.

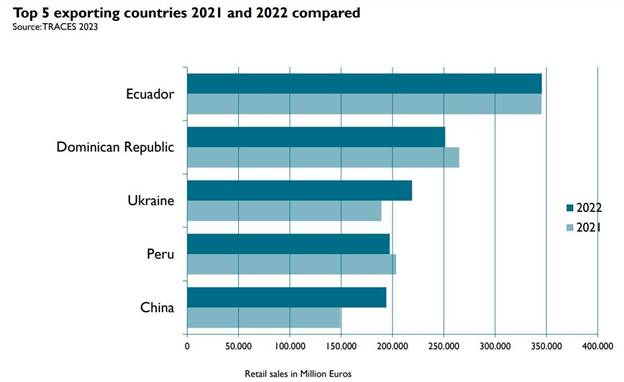

Figure 1: EU organic imports: Top exporting countries 2021 and 2022. Source: Traces, European Commission

Key data and trends 2021 globally

Since the beginning of the data collection on organic agriculture, the global organic area has increased by over 400%, while organic retail sales have grown by over 700% (2000-2021). In 2021, nearly 77 million hectares, or 1.6% of agricultural land, were under organic management worldwide. The global retail sales of organic food reached almost 125 billion euros in 2021.

Along with the continuous growth of organic area retail sales, organic imports into the European Union and the USA have shown an upward trend (data for both trade blocs available since 2018), and a total import volume of 4.9 million metric tons was noted in 2022.

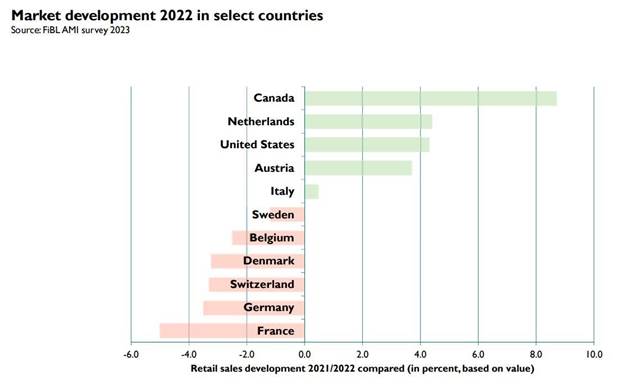

The global organic food market has faced challenges in recent years. Geopolitical conflicts and rising food prices have had a negative impact on the sector. After a record-breaking year in 2020, market growth slowed in 2021. Many countries experienced lower growth or even decline in 2022 due to weakening consumer demand, inflation, high food prices, and food security concerns. In the USA and Canada, however, organic retail sales increased by 4.4 and 8.7%, respectively.

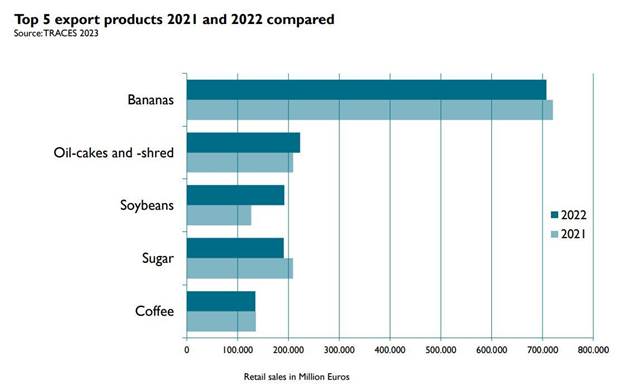

Figure 2: EU organic imports: Top crop groups 2021 and 2022. Source: Traces, European Commission 2023

European trends 2022: Farmland trends

In 2021, European organic farmland witnessed remarkable growth, surging by 8%, surpassing previous years’ rates. At the time of writing, available data for 2022 revealed that most European countries continued to expand their organic farmland. Nevertheless, within the European Union, the growth rate was slightly lower than that observed in 2021; however, an organic area share of more than 10% was achieved (approx. 17 million hectares). Across Europe, there was a decline in organic farmland due to reduced certified farmland reported in Belarus, the Russian Federation, and Ukraine. Achieving the ambitious target of reaching 25% organic farmland by 2030, as outlined in the European Commission’s Farm to Fork Strategy, will demand sustained efforts. It is crucial to implement appropriate support measures to incentivize farmers to transition to organic agriculture. Encouragingly, some countries, like Portugal and Greece, exhibited exceptional growth in 2022, demonstrating that a significant increase by 2030 remains feasible.

European import trends 2022

For European organic import several notable trends emerged with the 2022 data: There was an overall slight decrease in import volume in 2022, which can probably be linked to market stagnation. However, there was an increase in cereal and oilseed imports during the same period. Additionally, there was a notable increase in EU organic imports from China, which can be attributed to post-pandemic recovery in China and from Ukraine due to challenges in shipping to the USA. Moreover, there was an uptick in soybean imports from Africa (Togo) (Figure 1, Figure 3).

Figure 3: Change in organic retail sales 2021/2022 based on retail sales in million Euros. Source: National data sources compiled by FiBL

European retail sales trends 2022

In 2022, the European organic market faced several challenges. The cost of living surged in many countries, with inflation reaching unprecedented levels, causing some consumers to reduce spending on organic products. However, consumer awareness of organic, environmental, and health issues persisted. To cope with rising prices, some consumers turned to discounters, leading to continued growth in organic product sales in these outlets. While in several countries the organic market declined in 2022 (see Figure 3), some countries, such as the Netherlands, Austria or Italy, experienced further growth.

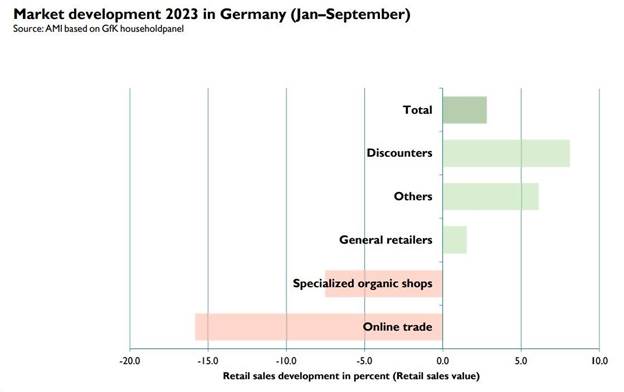

Figure 4: Market development by channel in Germany, January to September 2023 (based on retail sales value in Euros). Source: Agricultural Market Information Company 2023

2023 retail sales trends

While many consumers adjusted their purchasing habits in response to economic pressures, 2023 brought some positive changes. Data from Germany, for example, shows an increase in sales of fresh organic food from January to September 2023 compared to the previous year (Figure 4). Discounters continued to experience the highest sales growth, but overall purchasing volume remained slightly below the previous year.

According to the presentation of Lee Holdstock at the 2023 Congress of IFOAM Organics Europe “Europe Meets Business,” many EU organic markets are seeing value improvements in 2023, but volumes are still reduced for some. He also stated that comparing performance with 2020 and 2021 is not helpful as these were exceptional years. According to Holdstock, diverse routes to market – including local sustainability-focused chains (e.g. Italian Bio Districts) could make a significant contribution.

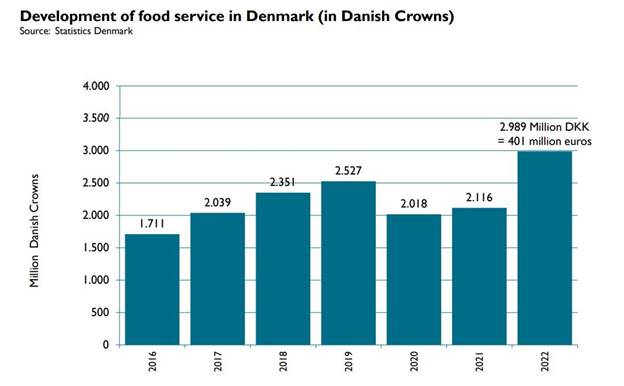

Another notable trend is the considerably stronger growth of organic catering sales compared to retail sales in several countries during 2022. Given that 2021 was still influenced by the impact of the pandemic, it is more instructive to examine the comparison between 2019 and 2022. For instance, in Denmark, organic catering sales surged by 18% from 2019 to 2022, surpassing the 9.2% increase in retail sales during the same period (Figure 5). While data on organic catering/food service sales are limited in many countries, the trend observed in Denmark is indicative of a broader pattern observed in other countries as well, such as France.

Figure 5: Denmark: Increase of organic catering sales 2016-2022. Source: Statistics Denmark

Conclusion

In summary, the global organic agriculture sector faced various challenges in 2022, including market stagnation, rising prices, and changing consumer preferences, particularly in Europe. However, in 2023 the situation was improving. Achieving the ambitious goals of organic farming growth requires addressing current challenges. With concerted efforts and innovative strategies, the organic industry can continue to play a vital role in promoting sustainable and healthy food systems worldwide.

Sources:

- The data collection is supported by the Swiss State Secretariat for Economic Affairs, IFOAM Organics – International, the Coop Sustainability Fund, NürmbergMesse.

Authors: Helga Willer, Jan Trávníček and Bernhard Schlatter | Research Institute of Organic Agriculture (FiBL)

Article Originally Published in Bio Eco Actual International Yearbok 2023 – Trends 2024.

Source: Bio Eco Actual, International Organic Newspaper

To view source article, visit:

Organic & Non-GMO Insights February 2024