By Megan Thomas, economist, Mercaris

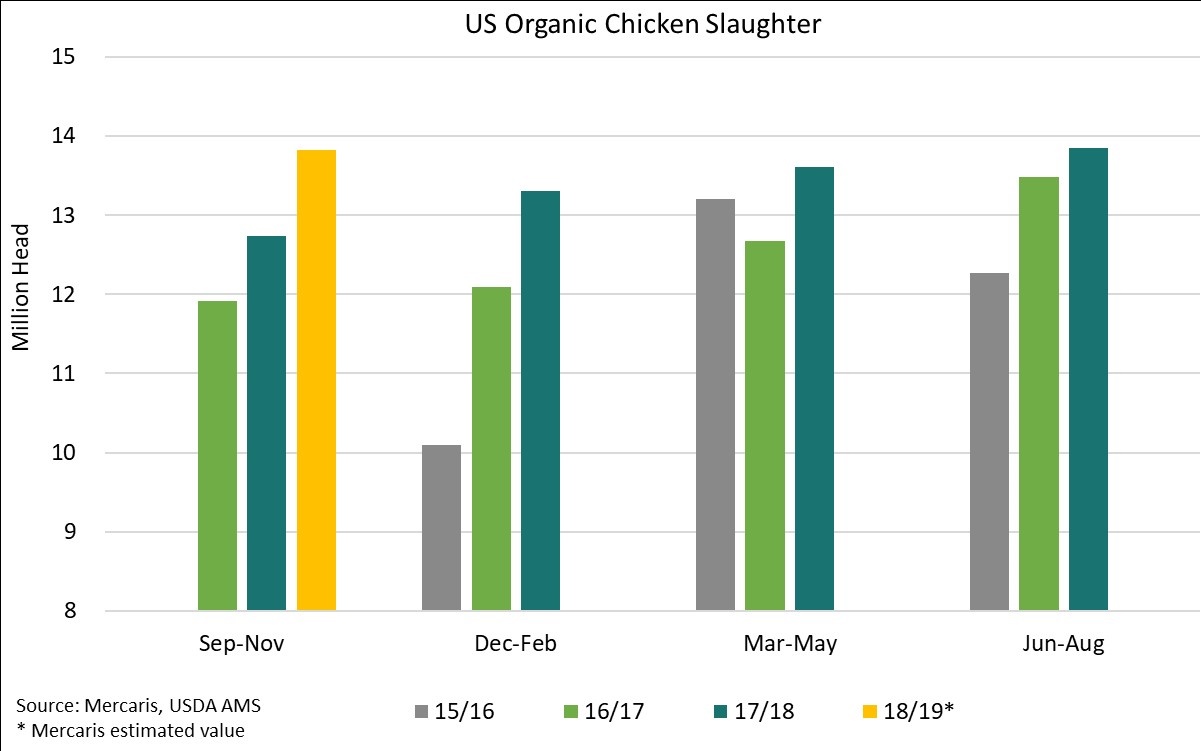

Organic livestock feed demand continues to surpass domestic production in the U.S. with organic corn and soybean meal imports filling the demand gap. Organic poultry is leading the growth in organic feed demand with the USDA Agricultural Marketing Service (AMS) reporting that 53.5 million organic broilers were slaughtered in the U.S. from September 2017 to August 2018 (2017/18 marketing year), an expansion of 7 percent year over year (y/y).

Beyond broilers, organic egg layers and organic milk cows both increased y/y production at 11 percent and 2 percent, respectively according to AMS. Some of the increased domestic feed demand is being filled by a 2 percent y/y bump in domestic organic field crop acreage. As Mercaris noted in last month’s 2018 Organic and Non-GMO Acreage Report, organic corn and soybean acreage expanded by 2 percent and 7 percent y/y, respectively. The remainder of the livestock feed demand is being filled by a surge in imported cracked corn and soybean meal.

In an effort to meet sustained growth in organic livestock feed demand, the U.S. imported 83,628 metric tons (MT) of organic whole corn during the last quarter of the 2017/18 marketing year, according to USDA Global Agricultural Trade System (GATS). This represents a 22 percent increase in imports as compared to the same time in the previous marketing year.

Mercaris’ Maritime Import Report (MIR), which documents U.S. maritime imports of organic whole and cracked corn, soybeans, and soybean meal, found that organic cracked corn imports increased 306 percent during the last quarter of the 2017/18 marketing year compared to the same time last year. Looking at the 2018/19 marketing year, whole corn imports were up 13 percent y/y in September 2018 according to USDA GATS. Moreover, Mercaris’ MIR reported that cracked corn imports were up 234 percent over the first two months of the 2018/19 marketing year, compared to last year.

Organic soybean imports were pulled lower over the 2017/18 marketing year, with both a decrease in access to foreign supplies and an increase in soybean meal imports limiting trade. According to USDA GATS, U.S. whole soybean imports reached 382,438 MT over 2017/18, down 4 percent from the prior marketing year. A major cause of this decline was a large reduction in U.S. soybean imports from Turkey. Over 2016/17 Turkey was the largest single foreign supply of soybeans to the U.S., accounting for 43 percent of imports over the marketing year. However, this has changed drastically with U.S. imports from Turkey declining 76 percent y/y over 2017/18. Another factor that is reducing U.S. organic soybean imports is organic soybean meal imports which have rapidly expanded over 2017/18. Mercaris’ MIR reported that U.S. organic soybean meal imports reached 171,312 MT over the 2017/18 marketing year, a 71 percent increase from the prior marketing year.

The start of the 2018/19 marketing year is slightly less robust, with soybean meal imports up 17 percent y/y over the first two months. However, 2018/19 is still in its first quarter, and U.S. organic livestock producers have shown a consistent demand for imported organic soybean meal over the past year. As organic livestock feed demand continues to expand beyond domestic supply, the U.S. will likely continue to increase domestic production as well as diversify its sources of imported organic feed grains.

Source: Mercaris

For more information visit www.mercaris.com.