By Megan Thomas, economist, Mercaris

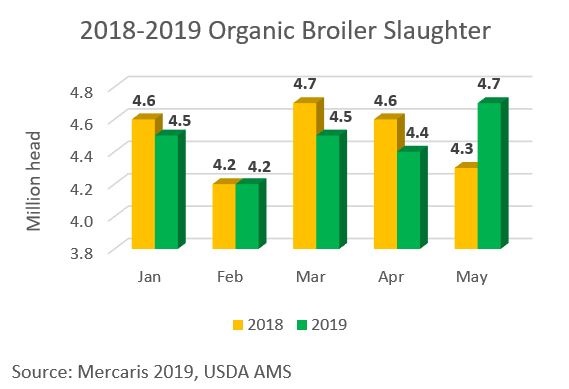

Processing of organic broiler chickens experienced gains over the second quarter of 2019 after a slow start to the year. Through May, organic broiler chicken slaughter was nearly even with levels from one year ago, reaching 22.4 million head according to Mercaris and U.S. Department of Agriculture, Agricultural Marketing Service (AMS) estimates. But in May, organic broiler slaughter reached 4.7 million head, up 6 percent from April. The sudden uptick in organic broiler slaughter could be seasonal as we move into the summer months and demand for grilling meat rises.

Unlike organic broilers, the organic cage-free layer chicken flock sizes have remained mostly above last year’s levels. Organic cage-free layer inventories reached 15.8 million head according to USDA AMS during May, a modest 1 percent growth over both the previous month and one year ago. But the 1 percent year-over-year gain seen in May remains well below the growth rates previously achieved by the industry.

Organic dairy production has also weakened, with 2019 organic fluid milk sales falling below 2018 levels through April of this year. April 2019 fluid milk sales were 17 percent lower compared to the April 2018 and 13 percent below April 2017. Declines in organic fluid milk sales may signal changes in consumers’ preferences as they opt for other dairy-based products.

Meanwhile, organic imports are increasing this year and expected to continue growing throughout the summer months. Organic soybean meal imports have seen sustained growth since the beginning of the 2018/19 marketing year. The U.S. increased organic soybean meal import activity from India this year, up 91 percent throughout 2017/18. May’s organic soybean meal import volumes were the third largest on record, and exceeded last year’s imports by 137 percent.

Organic whole and cracked corn combined imports were up 40 percent in May compared to last year. Organic cracked corn imports have been above 2018 levels since the beginning of the year, up 8 percent from April. Organic whole corn imports increased slightly in May from the previous month, but remained below 2018 levels.

Organic whole soybean imports continued their steady decline and fell to their lowest level since November 2011, with supplies coming only from India and Canada.

The trend of increased organic imports to supply the organic livestock industry is expected to continue as we move through the summer months and into the third quarter. Further evidence to support the sustained growth in imports is the uncertainty surrounding the spring 2019 crop harvest due to heavy rains and late planting. Organic livestock producers may become more reliant on imports to meet expected shortages in supply. It will be critical to keep an eye on the market as it is still too early to tell what impact the flooding will have on supplies. These market changes will have significant implications for organic meat supplies and feed demand through the summer of 2019.