Organic prices and production on track to bring more market turmoil over the year ahead

By Ryan Koory, vice president of economics, Mercaris

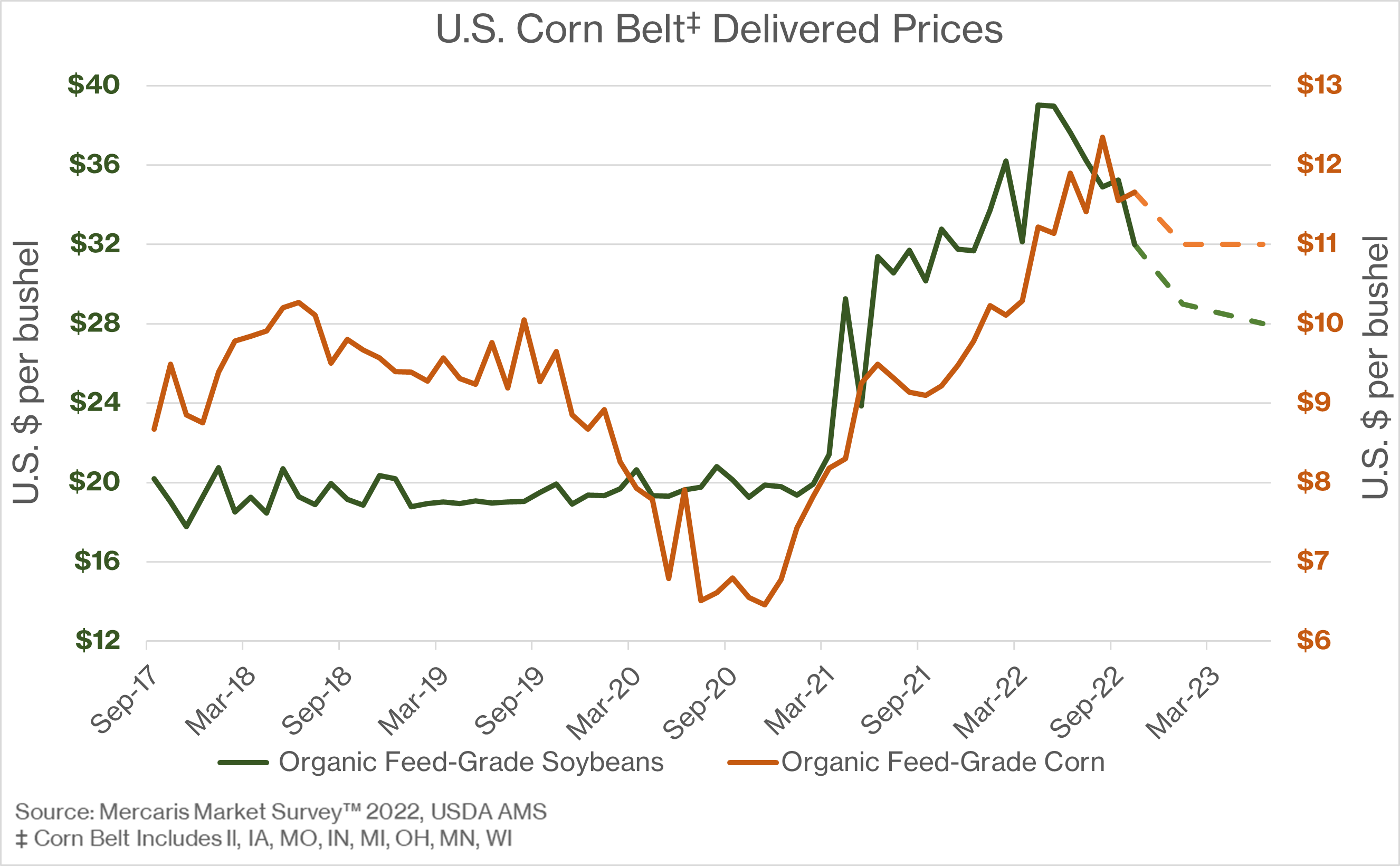

Market fundamentals for organic corn and soybeans appear set to diverge again over 2022/23 as U.S. production and imports continue to buck expectations. After two years of record supplies, organic soybean markets have begun the 2022/23 marketing year with noticeably bearish price pressure. In contrast, organic corn prices have found solid footing, with a significant possibility of sustained price support through the first half of 2023.

Since reaching a peak average of $39 per bushel over June, delivered U.S. Corn Belt organic feed-grade soybean prices have steadily fallen to nearly $30 per bushel over October. The long-supply position contributing to this situation emerged somewhat unexpectedly, as organic soy imports exceeded expectations over 2021/22 contributing to large organic soybean and soybean meal carryover stocks. Mercaris estimates U.S. organic soy carryover stocks reach the equivalent of 4.5 million bushels at the start of 2022/23, or 43% of 2021’s U.S. organic soybean harvest. These carryover stocks, in combination with another record U.S. organic soybean harvest, are expected to push organic soy supplies above 16.4 million bushels over the first quarter of 2022/23, or up 34% year-over-year.

In contrast, organic corn appears to have found a firm floor over the summer months of 2022, with delivered U.S. Corn Belt prices for organic feed grade corn consistently between $11 and $12 per bushel since April of 2022. The support for organic corn prices appears at first unexpected, as the 2022/23 marketing year is estimated to have begun with 4.5 million bushels of carryover stocks. However, these supplies are expected to be largely offset by a 6% drop in U.S. organic corn production this fall. Furthermore, reduced production in Argentina and Canada, as well as supply constraints within the Black Sea region, are expected to pull U.S. organic corn imports lower over 2022/23 further tightening U.S. supplies.

With market fundamentals pushing organic corn and soybean prices in opposite directions, Mercaris anticipates 2023 will bring a substantial shift to U.S. organic acreage. After increasing by nearly 100,000 acres over the past two years, Mercaris projects U.S. organic soybean area could decline 25% over 2023, or by about 80,000 acres. Half of these acres are expected to rotate into organic corn production, driving organic corn harvested acres up 11% year-over-year. Assuming yields achieve trend levels, Mercaris estimates U.S. organic corn production will reach a record-setting 52.8 million bushels over 2023 while organic soybean production declines to only 9 million bushels.

These swings in U.S. production are likely to result in additional price risks for both producers and purchasers of organic commodities. Assuming markets follow current expectations, organic soybean prices are expected to find stability by the fall of 2023 as organic corn prices lose support and begin moving lower. However, as acreage works to respond to changing price levels, the risk imports and weather pose to these markets will remain heightened. Any market shock could quickly move supplies into either short or long positions again, further extending this period of oscillating prices and perilous price risk.