By Alexander Schultz, economist, Mercaris

U.S. markets for organic corn and soybeans face several potential sources of supply risk in the 2023/24 marketing year, which could create significant price volatility according to the most recent Mercaris Commodity Outlook.

Organic corn acreage to reach record levels

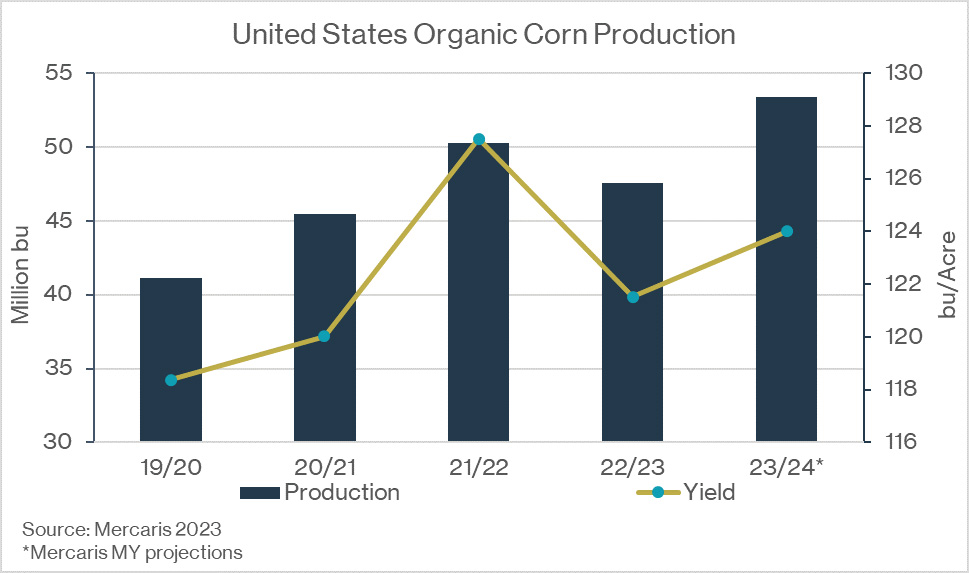

In the report, Mercaris estimates the United States will end the 2023/24 marketing year with the second largest volume of organic corn carryover stocks on record. While building ending stocks are expected to put further pressure on prices over 2023/24, there is significant risk to United States organic corn production. Mercaris forecasts organic corn acreage to reach record levels for the 2023/24 marketing year after a slight dip during 2022/23. High soybean prices in recent years have sharply pushed up soybean acres, but farmers are now facing both lower organic soybean prices as well as agronomic pressures from several consecutive seasons of soybeans.

However, organic corn prices have trended weaker as well, which could push some acreage into alternative crops such as sunflower. Mercaris’ Commodity Outlook also forecasts yield to return closer to historical trends. However, the early months of the 2023 growing season have been dry in several major producing areas. This creates the risk of another year of below trend yields, which would counteract the expected acreage increase and limit the build of ending stocks over 2023/24.

The continued war in Ukraine also poses threats, especially on the import front. A deal to allow grain exports out of Ukraine has been extended through mid-July 2023. Ukraine and Russia are major sources of organic corn for mills in Turkey which exports organic cracked corn to the United States. A shutoff of this supply would further limit organic cracked corn imports by the United States, which are already forecast to fall 20% year-over-year in 2023/24.

Organic soybean market risks

Mercaris has also identified supply risk within the organic soybean market in 2023/24. The organic soybean market is forecast to enter the 2023/24 marketing year with record carryover stocks, likely providing a partial offset to declining production and imports over the marketing year. However, a significant decline in imports and production could quickly reverse the market into a bullish tone if they fall farther than expected. Mercaris currently forecasts 2023/24 organic soybean production will decline after the record 2022 harvest to a level closer to 2021/22. As discussed above, some organic soybean acreage is expected to rotate back into organic corn in 2023/24 as prices have dipped into the low $20 per bushel range after exceeding $40 per bushel a year prior, while yields improve to historic trend levels. However, if acres do not shift out of organic soybeans at the level expected, it could push the market to end 2023/24 with another year of significant carryover stocks.

There is significant supply risk for imports too, which account for about 70% of United States organic soybean supplies. Argentinean traders have indicated that the harsh drought and freeze that struck many of the organic soybean growing regions has already led to at least a 50% drop in production, but the full impact of these adverse conditions will not be known until the harvest is complete. Mercaris currently expects whole organic soybean imports from Argentina to fall by 33% over 2023/24. Any additional losses in Argentine supplies would be significant considering the country accounted for over 40% of United States organic whole organic soybean imports through April of the 2022/23 marketing year. Mercaris already expects a further drop in Black Sea soybean imports during 2023/24, but any further exacerbation of these tensions could further decrease volumes.

The 2022/23 marketing year is also expected to end with record levels of organic soybean carry-over stocks. This significant supply surplus carries bearish price risk for 2023/24, which could have significant implications for imports. Through the first half of 2023, United States domestic prices for whole organic soybeans and organic soybean meal have remained above international levels. However, as domestic pricing continues to fall it could affect the willingness of countries to send organic soybeans to the United States. African exporters have indicated a willingness to shift organic soybeans otherwise destined for the United States to Asian markets as non-GMO beans where they face lower grain inspection standards. Organic soybean prices have remained somewhat resilient, which will put a floor on the non-GMO price even if organic prices continue to fall. United States Organic soybean imports will have to fall in order for the market move out of the current long supply position, but if they fall too quickly the market could suddenly be left tight.