By Ryan Koory, director of economics, Mercaris

In many ways 2020 is a year of unexpected and permanent change. Not to be the exception, the U.S. organic industry may well look back at 2020 as the point where organic matured past its niche beginnings, becoming a global commodity market. With this transition organic prices have left behind the relative stability of the past five years, beginning a new phase in which understanding the market’s supply and demand factors is critical.

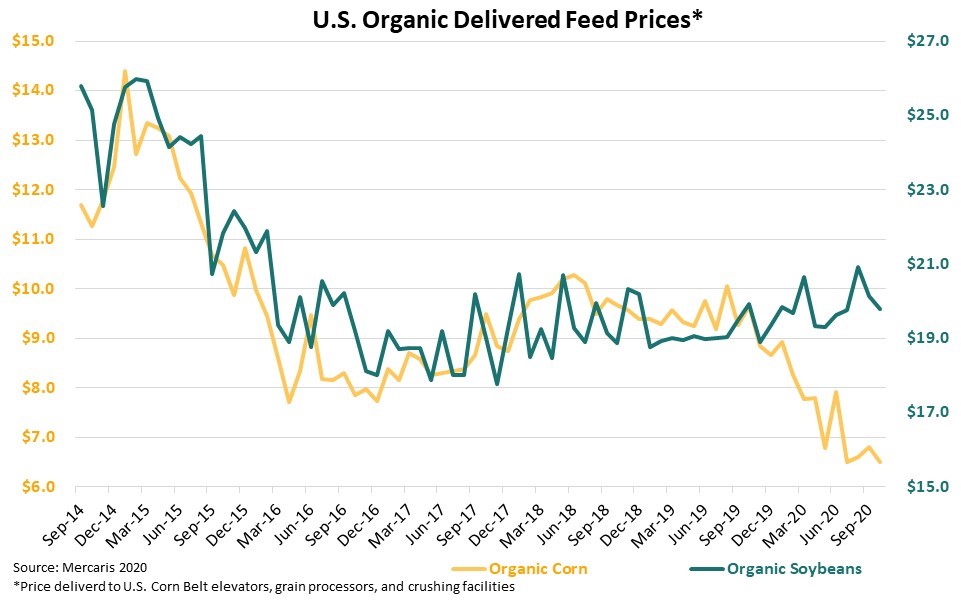

The divergence of U.S. organic corn and soybean prices over the past year provides striking evidence. Over September 2020, organic feed-grade corn delivered to U.S. Corn Belt grain elevators averaged $6.80 per bushel (bu), down nearly $2.50/bu year over year (y/y). Furthermore, Corn Belt delivered organic feed-grade corn prices have held persistently below $7.00 since June of this year, marking their lowest level since prices collapsed in 2009 following the global recession. By contrast, organic feed-grade soybeans have fared quite well, with delivered prices to Corn Belt grain elevators averaging $20.20/bu over September 2020, up about $0.20/bu y/y.

The collapse of U.S. organic corn prices over the past year is itself noteworthy, however the more striking event may be the greatest divergence between organic corn and soybeans prices in more than 5 years. Although prices for these two commodities were never in reality tied to each other, they have clearly taken similar paths following the growth of U.S. organic livestock production and consumer demand. Recently though, the same factors that moved organic corn and soybean prices in tandem historically have themselves split, leading these commodities down very different price paths.

First, looking at organic corn, Mercaris estimates that between the 2016/2017 and 2019/2020 marketing years, U.S. organic corn production grew at an average rate of 12% per year, while feed demand grew at an average rate of only 1% per year. This discrepancy resulted in a declining reliance on imports, down from 21 million bushels, or 42% of supplies, during 2016/2017, to just 16.5 million bushels, or 29% of supplies, during 2019/2020. However, this trend also resulted in a U.S. organic corn market stuck in a perpetually long supply position since the 2019 harvest.

Organic soybean production has grown a bit slower, at 11% per year between 2016/2017 and 2019/2020, while feed demand growth averaged 6% per-year over the same period. The smaller gap between feed demand and production growth has held organic feed-grade soybean prices much steadier compared to organic corn.

However, the U.S. is also persistently reliant on imports to fill demand. Mercaris estimates combined U.S. organic soybean and soybean meal imports reached 27.7 million bushels over the 2019/2020 marketing year, or 78% of supplies, little changed from 79% of supplies, or 20.1 million bushels imported over 2016/2017.

This comparison is convenient as it provides a position to view marketing year risks for the year ahead. As always, demand will remain a closely watched driver of organic commodity prices, as the U.S. economy faces a year full of uncertainties. For supply, organic corn prices are likely to be driven by the size and quality of 2020’s harvest, which currently appears set to reach record levels. Organic soybeans are also expected to see a record harvest. However, imports will likely remain the majority of U.S. supplies. Given this, freight, foreign production, and disruptions to global trade are all likely to weigh more heavily on organic soybean prices in the year to come.

However useful these observations might be for near-term decision making, the long-term implications are much more significant. For all commodities, price is a response to the less obvious movements of supply and demand. As U.S. organic markets continue to grow, shifts in these less obvious market forces will become larger, less predictable, and more impactful. Staying ahead of this reality with access to more and better market information will be the key to success.