By Ryan Koory

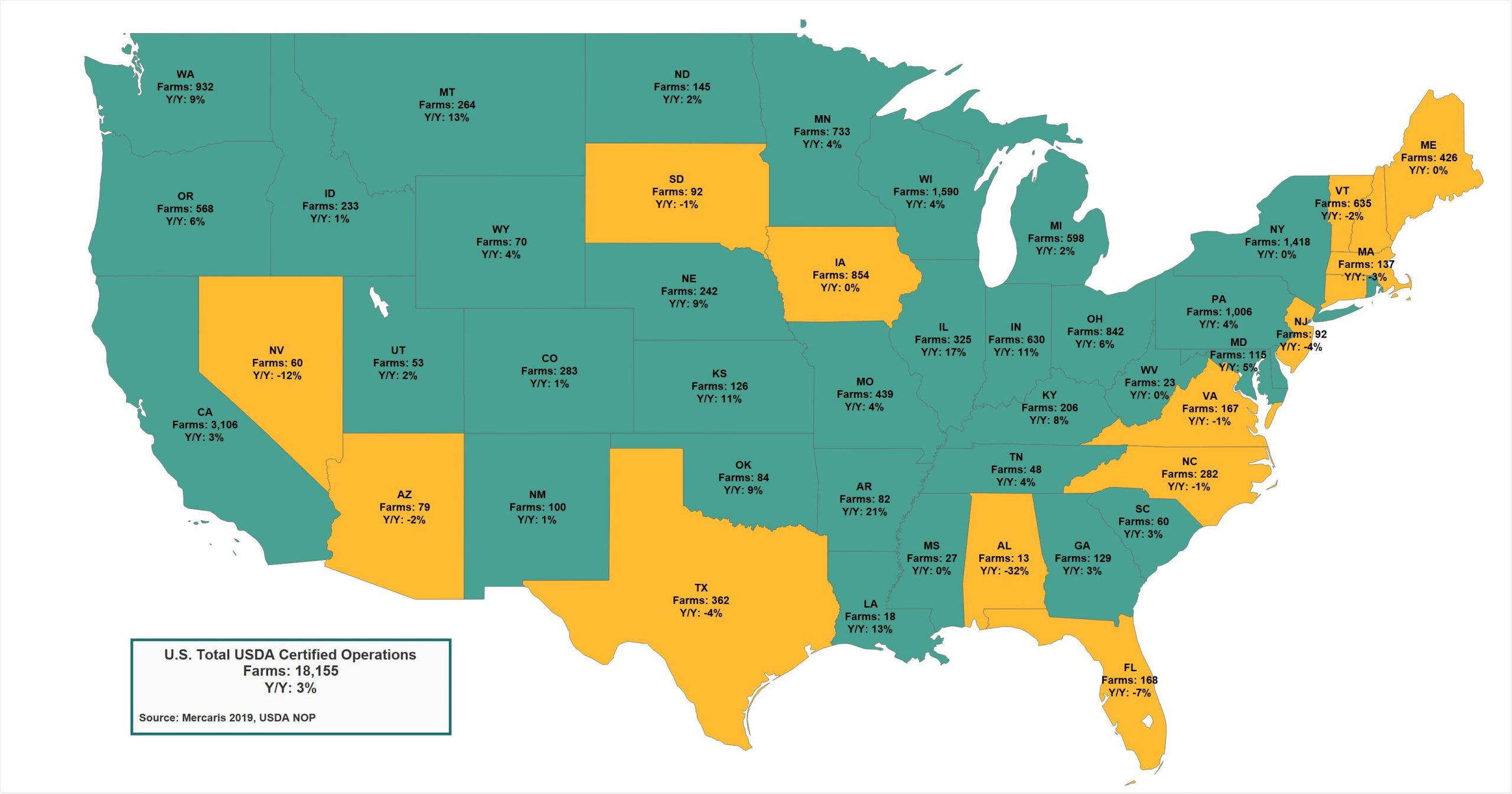

Despite a growing number of USDA certified organic farm operations, organic corn and soybean harvested area is projected to shrink this year. Mercaris recently released its 2019 Organic and Non-GMO Acreage Report estimates the number of certified organic farms grew by 3 percent this year to reach 18,155. This growth is spread across multiple field crops including organic wheat and organic soybeans which increased by 4 percent each, and organic corn which grew by an impressive 8 percent.

Despite the continued growth in the number of organic farms, the overall acreage and production outlook this year is less positive. With persistent cold and wet weather conditions crippling organic operations across the Midwest, the number of harvestable acres is forecasted to decline across a large section of the U.S. Many states, including Wisconsin, New York, Minnesota, Michigan, and South Dakota are expected to see organic corn harvested area decline by 5 percent or more despite a growing number of certified organic operations planting corn this year. However, a few states including Illinois, Nebraska, and Iowa are expected to see harvested organic corn area expand this year. In nearly every state with projected harvested area growth, the growth appears to be the result of an increase in the number of organic farms while the number of harvested acres per farm is projected to decline.

Organic soybean acres are following a similar trend, with harvested acres projected to decline by 8 percent despite an overall growth in the number of certified organic farms. However, organic soybean acres are expected to decline less dramatically due to a smaller expected reduction in the number of acres harvested per farm. Mercaris projects that the number of organic soybean acres harvested per farm will decline 11 percent this year, compared to a 17 percent decline in organic corn acres harvested per farm.

It is clear that both weather and industry growth shaped this year’s organic corn and soybean acreage outlook. While the number of acres planted per operation is expected to decline for both organic corn and soybeans, the decline in acres is 27 percent larger for organic corn. This is likely a reflection of weather limiting planting opportunities for both crops, but also indicates that some acres shifted toward organic soybeans in response to delayed organic corn planting.

Comparing the growth in the number of certified organic corn and soybean farms, the perspective is positive and not unexpected. Following slower growth in organic corn planting in 2018, it was anticipated that organic crop rotations would push more acres back into organic corn in 2019. Additionally, the overall number of certified organic field crop operations grew by 6 percent this year. Because organic corn is often the most profitable crop in an organic rotation, farmers often plant it the first year out of the organic transition phase. Given the overall growth in the organic industry this year, and the factors set to push more farmers towards organic corn, the 8 percent and 4 percent growth rates in organic corn and soybean producers, respectively, are not surprising in the least.

In contrast to the rocky outlook for organic corn and soybean harvested acres this year, organic wheat acres appear steady and positive. On a state by state basis, the outlook is mixed with the number of harvested acres declining across many Midwestern states offset by larger gains in the Northwest and central plains. Overall, Mercaris estimates that 2019 U.S. harvested organic wheat acres will increase 4 percent over 2018, due almost exclusively to continued growth in the number of certified organic operations producing organic wheat.