By Ryan Koory, vice president of economics, Mercaris

To say the U.S. organic soybean market unraveled over 2021 is a fair assessment. January brought an end to the U.S. Department of Agriculture’s organic recognition agreement with India. In March, the Organic Soybean Processors of America submitted a petition for anti-dumping and countervailing duties against Indian organic soybean meal, which is likely to result in tariff rates as high as 266%. Finally, October saw India respond to certifier-blacklisting by the European Union by significantly cutting the authority of four Indian organic certifiers while issuing a full one-year suspension of another.

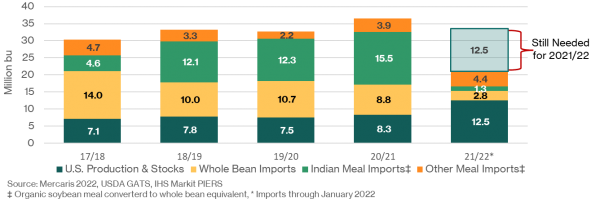

These events, in addition to ongoing global supply chain challenges, left the U.S. organic soybean market with a supply deficit. To gauge the size of this deficit, its useful to first assess U.S. demand. According to Mercaris estimates, U.S. organic soybeans for food use and residual averaged 2.1 million bushels from 2019 to 2020. Additionally, U.S. organic soybean demand for feed use averaged about 31.4 million bushels over the same period. Assuming the 2021/22 marketing year follows a similar trend, total demand is set to reach 33.5 million bushels.

Historically, nearly 40% of U.S. organic soybean supplies have been sourced as organic soybean meal from India. However, since the start of 2021/22 imports from India have plummeted to their lowest level since 2016. In response to this drop, imports from other countries have grown more than 208%. However, these gains have only accounted for about half the decline in imports from India. Putting these shifts in trade into the perspective, U.S. organic soybean meal imports reached 135,000 short tons through January of 2021/22, or the equivalent of 5.7 million bushels of organic soybeans according to Mercaris estimates.

With the drop in organic soybean meal imports, there was an expectation of rebounding whole soybean imports following an increase in U.S. organic soybean crush. However, this has not been the case. Through the first five months of 2021/22, U.S. organic soybean imports reach an eight year low at 2.8 million bushels, down nearly 14% from 2020/21. In total, combined imports of organic soybeans and soybean meal saw the lowest levels to start a marketing year since 2015/2016 at 8.5 million bushels through January.

U.S. farmers have responded to the tightening import outlook. Mercaris estimates U.S. organic soybean production reached 10.4 million bushels over 2021, a 25% jump from the prior year. Additionally, following a large increase in imports over 2020/21, Mercaris estimates that 2021/22 began with 2.1 million bushels of organic soybeans in carryover stocks. With the tremendous response in U.S. production, carryover stocks and weak imports, total U.S. organic soybean supplies are estimated to have reached their highest level on record at 21 million bushels as of February 2022. However, assuming organic soybean use reaches 33.5 million bushels, the U.S. will need to source an additional 12.5 million bushels before September.

Foreign supplies are likely to play a large role in filling this gap. If imports of organic soybeans from Canada remain strong, Argentine imports don’t falter again due to ongoing drought, and imports from the Black Sea region avoid disruption, it’s possible the U.S. could import another 4.3 million bushels before this fall. For organic soybean meal, again, if imports from Canada and the Black Sea continue, and imports from Africa remain steady, then it’s possible the U.S. will import another 5.2 million bushels.

That still leaves a gap of 3 million bushels, which could be covered by better than expected imports or substituting feed ingredients. However, this gap could just as easily expand if imports fail to meet expectations.

This three-million-bushel gap has implications for next year as well. If the 2022 harvest sees U.S. production expand and imports improve next year, then the U.S. organic soybean market will have room to relax and move off its current highs by this fall. But, if the three-million-bushel gap expands, U.S. production faulters, or imports fail to recover, then 2023 is likely set for another year of tight supplies.