By Ryan Koory, director of economics, Mercaris

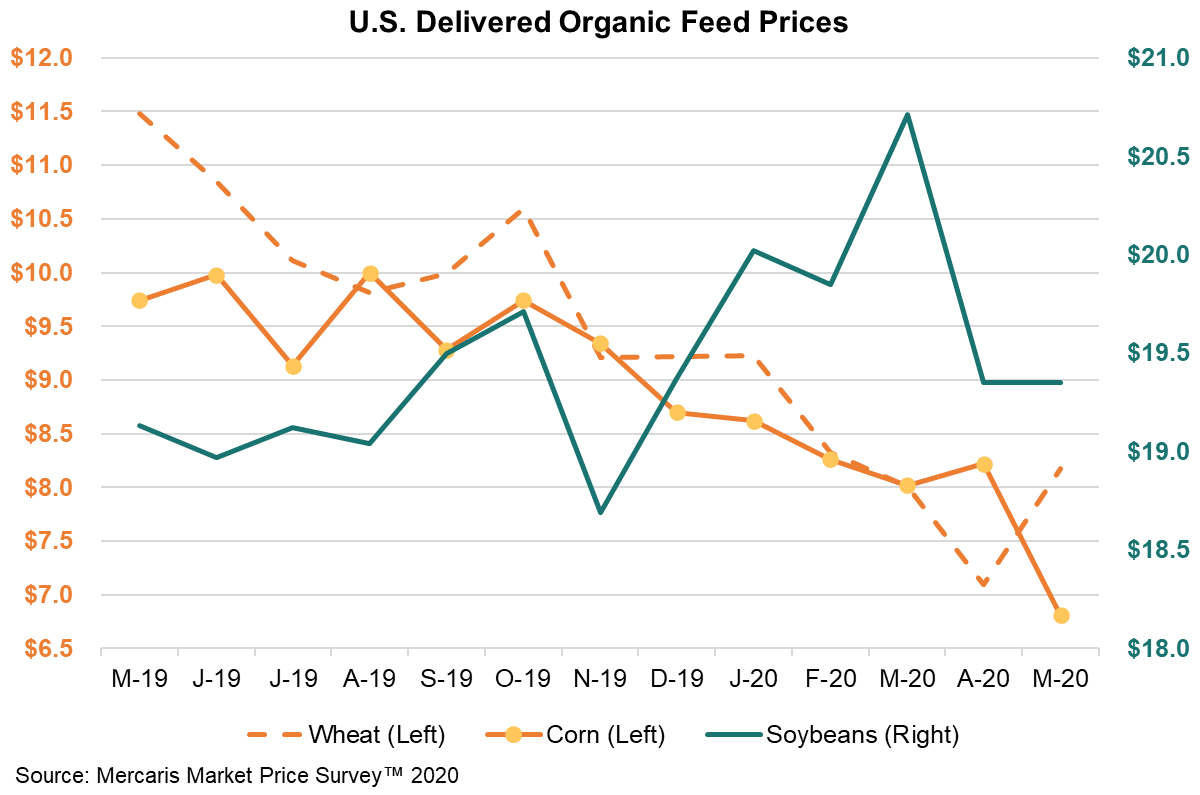

As spring gives way to summer, the end of June is a perfect point to review the market and plan for the year to come. Looking back, 2019/20 began as a mixed bag for organic feed markets. Organic corn, wheat, and soybeans all struggled through 2019 as persistently cold and wet weather hampered both planting and harvest. While U.S. feed-grade organic soybean prices have held steady since September 2019—between $19.25/per bushel – $20.00/bu delivered according to Mercaris’ Market Survey price—organic corn and wheat prices have struggled.

The 2019/20 marketing year opened with purchasers long on organic feed-grade corn and a harvest that exceeded expectations. Under this weight, markets have seen U.S. organic feed-grade corn prices slide steadily lower, opening 2019/20 at $9.28/bu delivered in September 2019, and sinking to $6.81/bu delivered over May 2020. Following feed-grade corn, U.S. feed-grade organic wheat prices have also fallen, from $9.99/bu delivered in September 2019 to $8.18/bu delivered over May 2020.

Spring 2020 has compounded the 2019/20 downward trends with favorable planting conditions and the global COVID-19 pandemic. Mercaris estimates 95% of U.S. organic corn and 84% of U.S. organic soybean acres were planted as of June 6th, two full weeks ahead of 2019’s disastrous planting season. Weather through the end of June also proved more favorable, with sufficient rain and warming temperatures providing an early boost to this year’s crop. If this trend persists, 2020 will be on track for a record harvest this fall, in sharp contrast to 2019, leading to more downward pressure on commodity prices.

While 2019’s harvest and 2020’s planting season sowed the seeds of the marketing year to come, COVID-19’s global reach has uprooted all expectations. While a great deal can be said about COVID-19’s impact on the U.S., for organic markets risks can be generally be split into three categories—imports, livestock, and U.S consumers.

For imports, the first signs of COVID-19’s impact emerged in May as organic soybean meal imports declined substantially. In March and April, U.S. organic soybean meal imports from India dipped slightly year-over-year. However, imports fell in earnest over May, down 66% y/y, marking the largest decline since Mercaris began recording organic soybean meal imports in 2015. May’s decline is consistent with India’s reported shortages of shipping containers and labor. It’s likely U.S. organic soybean meal imports will remain reduced over June and possibly into July.

Beyond organic soybean meal, U.S. organic imports remain largely intact despite COVID-19. Organic soybean imports are likely to decline over the summer months as the market tightens seasonally. Additionally, organic corn and organic cracked corn imports are holding steady with pre-COVID-19 trends. Organic whole corn imports are tracking slightly above 2018/19 levels, while organic cracked corn imports remain lower year-over-year.

In U.S. organic livestock broiler meat production appears to have been most impacted, with USDA (U.S. Department of Agriculture) reported weekly organic broiler slaughter declining 37% y/y in the middle of April. In total, Mercaris estimates USDA organic broiler slaughter was 12% lower over March through May of 2020 than it would have been without COVID-19.

In contrast, organic turkey production has remained phenomenal. Organic turkey slaughter briefly faltered in April, but quickly recovered to end the month up 71% y/y per USDA data. In fact, organic turkey slaughter has emerged as the fastest growing section of U.S. organic livestock this year, reaching nearly 1.23 million head January through June, up 121% y/y.

Finally, both organic egg and dairy production have held steady, with consumer demand supported by an increase in food prepared at home, and production largely untouched by the challenges faced in other portions of U.S. agriculture.

In general, U.S. organic consumer demand remained strong over the spring as COVID-19 pushed meals out of restaurants and into homes. This momentum will likely carry into summer, with data provided by Safegraph.com indicating sit down restaurant foot traffic remained down 27% year-over-year as of June 15th. However, organic commodity markets may face headwinds beginning this fall if U.S. household incomes contract significantly in the wake of COVID-19 quarantines.

Altogether, it appears organic commodity markets have room to move generally lower over the next year. Imports—particularly organic soybean meal—could become restricted adding support to commodity prices. Keep in mind this is a market risk, and not to be relied upon. For organic livestock, despite setbacks this spring, production growth is holding a steady pace as consumer demand continues to expand. However, the outlook suggests that 2020’s harvest could exceed livestock demand growth, creating another year of excessive grain supplies and bearish pressure on organic crop prices.