By Ryan Koory, director of economics, Mercaris

Significant setbacks made the 2019 harvest one of the most challenging in recent history. With weather limiting planting opportunities, shortening the growing season, and producing the most difficult corn harvesting in a decade—all signs suggest higher organic commodity prices for the 2019/20 marketing year (my).

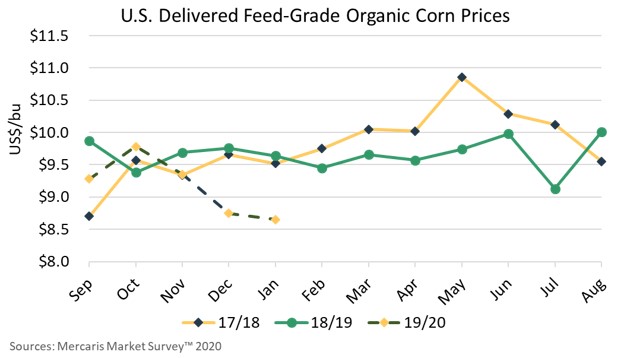

However, organic commodity prices since harvest are unexpectedly bearish. Mercaris’ Market Survey recorded the U.S. organic feed-grade corn price in December at $8.75 per bushel (bu), down more than $1.00 bu year-over-year (y/y). Meanwhile, U.S. organic feed grade soybeans averaged $19.40/bu, down nearly $0.90/bu from 2018. Taking December’s bearish tone as a starting point for 2020, we can find some valuable guideposts for the remainder of the year.

More carry-over, and robust industry growth ease U.S. supply concerns

In response to uncertainty caused by poor weather conditions in 2019, Mercaris observed an increase in new crop forward contracting and an uptick in old crop inventories, ahead of harvest. This shift in strategy, combined with a better than expected harvest, contributed to what many have described as an unexpectedly large volume of organic grain being carried into the 2019/20 marketing year.

Looking deeper into 2019’s harvest, beyond the challenges, what stands out is the growth in the number of U.S. certified organic operations. Mercaris’ 2019 final Organic and Non-GMO Acreage Report found that the number of organic corn and soybean acres harvested per operation fell 16% and 10% y/y, respectively, due to the challenging conditions. By contrast, the number of certified organic operations harvesting corn and soybeans increased 13% and 11% y/y, respectively, minimizing weather-related acreage losses.

Livestock feed demand throws curveballs

Organic feed demand continues to achieve record high levels. Mercaris estimates that, over the 2018/19 marketing year, U.S. organic livestock feed demand reached its highest level yet, growing 4% y/y and consuming an astounding 30.7 million bushels of organic corn. But, the sustainability of the growth of organic feed has become questionable. For the past three years, organic dairy has struggled to expand its share of the U.S. consumer market and organic dairy cow inventories have largely plateaued as a result. Organic broiler meat production, posted double-digit growth figures annually from the 2014/15 and 2017/18 marketing years. However, over 2018/19 that growth rate dropped below 1%, and thus far 2019/20 is on track to do the same.

Adding up the market risks

Putting all the data together, the resulting picture is a mixture of modestly bullish price opportunities over the spring and summer of 2020, with looming bearish risks by harvest time in the fourth quarter. The second and third quarter of 2020 hold real, but modest, bullish price risk as the market will have to ration out 2019’s reduced organic corn and soybean crop and slowing but steady growth in organic livestock feed demand.

This outlook does not address the influence of U.S. imports, which have dampened the impact of U.S. production and demand on organic commodity prices. But the flow of imports has moderated somewhat since harvest, with imports of organic whole and cracked corn, organic soybeans, and organic soybean meal all slowing.

By this year’s harvest, the price outlook appears decidedly more bullish. Given favorable weather, 2020 could see the full potential of last year’s boost in organic operations come to bear on U.S. harvested acreage. This, plus a return to normal yield levels, could add a significant volume of organic corn and soybeans to U.S. supplies this fall. Of course, this outcome is dependent on weather. That said, the organic landscape looks ripe for a sizeable boost in production, and downward price pressure if these factors align this year.