By Rachel Storey and Kellee James, Mercaris

With many consumers paying more attention to the quality of their food, as well as where it is coming from, demand has been shifting away from conventional grains and towards organic and non-GMO for quite some time. There are profound differences when it comes to buying or selling those grains. Here, we’ll focus on factors that impact businesses that source or sell non-GMO grain.

How Supply and Demand Match up

With conventional commodity prices trending lower, some U.S. farmers recognized that switching to non-GMO would allow them to lower costs for seed, and possibly increase revenue. Combined with favorable growing conditions, this has resulted in a rapid increase in supply, and even with demand growing steadily, it has caused premiums to decrease from the record highs we saw 3 years ago.

While there is very little we can do to impact market dynamics, we have learned a few things about the non-GMO grain supply chain and how to adapt to market conditions:

- Forward Contracts Make a Difference

For buyers that plan to source large volumes, require special grain characteristics, or have other tight market specifications, leveraging a forward contract is the most surefire way to obtain the supply needed at a competitive price. Likewise, growers that can deliver on these fronts can ensure a steady source of demand (and a premium) through forward contracting. Importantly, leveraging forward contracts inherently builds understanding of the ins and outs of the marketplace, which will also prove useful in instances where there is still grain in growers’ bins or unmet buying needs.

- Strong Logistics & Infrastructure Matter

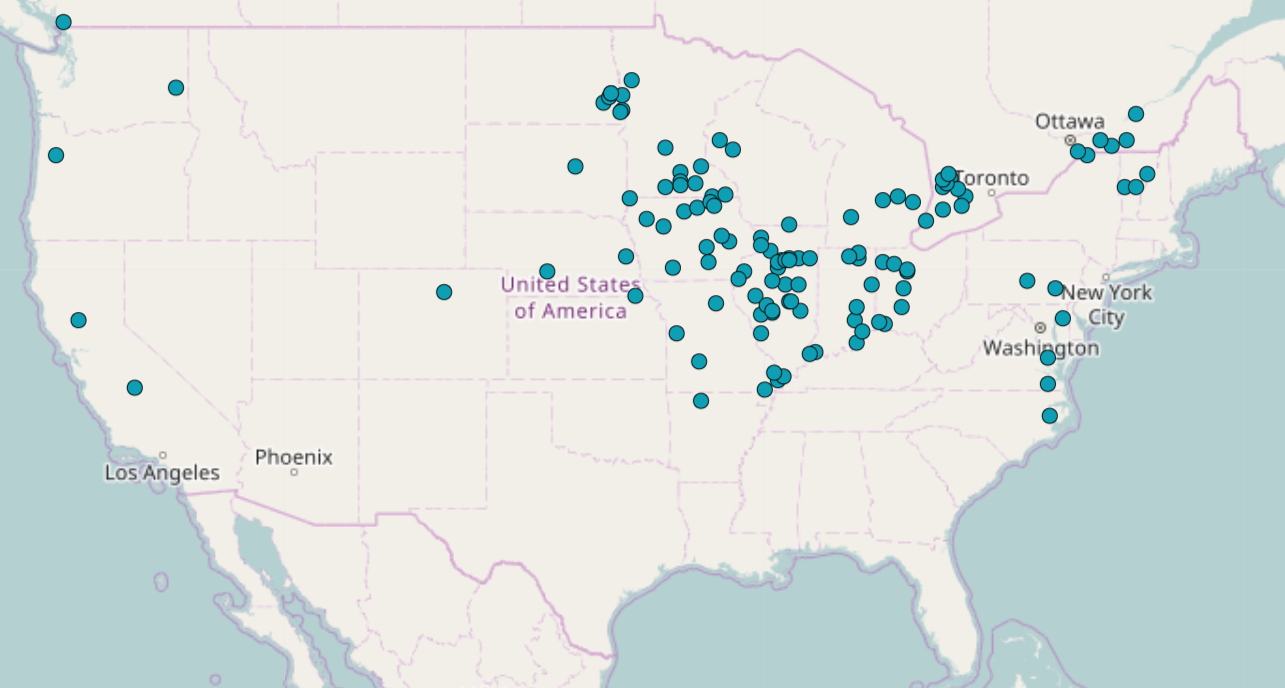

While forward contracting should be prioritized, sometimes it is unrealistic to expect to get all grain contracted ahead of time. In the absence of a forward contract, organizations with the most efficient infrastructure—or ability to move grain to where it is needed—tend to come out on top. On the supply side, that means being able to deliver at a moment’s notice. With flexibility to deliver on-demand, a seller will become more attractive to potential buyers that are still scrambling to meet their needs and that are willing to pay a premium to do it.On the buy side, this means operating—or having access to—an expanse of handling facilities that can undertake many different processes and, ideally, have wide geographic coverage. Mercaris maps out handling facilities nationwide and has found that, for example, the majority of non-GMO soybean processing facilities that service U.S. domestic demand (rather than export-oriented handling) are concentrated in a few Midwestern states (see map).Buyers that source and process non-GMO soybeans from this region may more easily find local processors, giving them more flexibility to purchase and process large quantities of cheaper non-GMO soybeans. Conversely, it could behoove an entrepreneurial non-GMO co-packer or manufacturer to open a plant in North Dakota, South Dakota, Nebraska, or Kansas—four of the top-10 non-GMO soybean growing states, with strikingly few processing facilities.

- Micro-regional Influences are Real

Mercaris gathers and publishes national and regional prices for non-GMO grain premiums and has found that even within regions there are considerable variations. For example, although non-GMO grain markets are somewhat long nationwide, there are geographic pockets where markets are tighter. Some of our recent auctions have revealed that in certain states like North and South Dakota and Illinois, there is insufficient supply to satisfy local demand for non-GMO soybeans—although nationally this market is long. Reaching out to these tighter markets can prove strategic and we have seen many good deals come out of these sorts of markets, despite sometimes-increased transportation costs.

The overall solution for ensuring a market exists for your non-GMO grain, whether buying or selling, is to have a plan in place before the crop year begins.

If you’d like more information about the unique attributes of non-GMO commodity and ingredients markets, Mercaris can help with a variety of tools to help you manage your supply chain or farm. Contact us at mercaris@mercaris.com or tweet us @Mercaris.