U.S. importers are replacing whole corn with cracked corn for use as animal feed

By Ryan Koory and Rachel Storey

In 2017 U.S. organic imports fell under scrutiny when a Washington Post article uncovered fraud along the international organic commodity supply chain, highlighting some conventional corn sourced from the Black Sea region that ultimately arrived in the U.S. falsely labeled as organic.

Soon after, the U.S. began to see a significant decline in organic corn imports, particularly those sourced from the Black Sea region. According to official trade statistics from the USDA Foreign Agricultural Service (FAS), in the first half of 2017, the U.S. imported more than 11 million bushels of organic corn; in the second half of the year import volumes dropped significantly, only reaching 4 million bushels. (For comparison, in the last half of 2016, 8.4 million bushels were imported, over double 2017 H2 figures.) The picture for the Black Sea region has gotten even more dramatic this year—in January fewer than 2,000 bushels of organic corn were imported from the region.

Although many might interpret the slowdown in organic corn imports as a direct result of the Washington Post article, there are at least two other major factors that very likely contribute to the continuing decline in imports. First, Mercaris estimates that U.S. organic corn production for the 2017/18 marketing year reached 43.4 million bushels, up 51 percent over the prior marketing year. Due to this new domestic supply, the U.S. is sourcing less corn from not only the Black Sea region, but also from major trade partners—so far, organic corn imports from Canada are down 9 percent this marketing year.

Second, and the focal point of this article, is that organic importers have recently been importing significant volumes of organic cracked corn from Turkey. Organic cracked corn remains without its own Harmonized Tariff Schedule Code—and therefore is not explicitly tracked—instead being lumped in with other milled cereal grain imports.

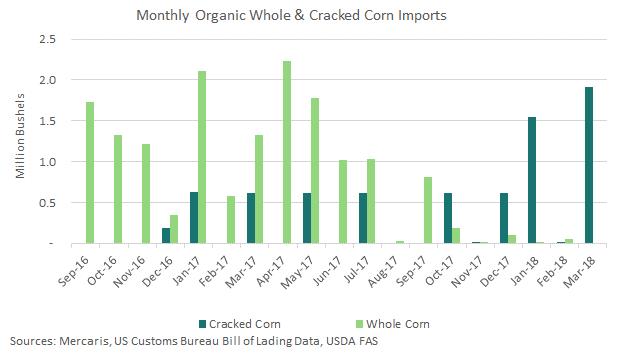

To account for the impact of organic cracked corn imports on U.S. organic markets, Mercaris produces its own estimate by using maritime bill of lading data from U.S. Customs. According to Mercaris, U.S. organic cracked corn imports have ballooned since the start of the 2017/18 marketing year, reaching an equivalent of 2.8 million bushels through February 2018. By comparison, U.S. organic whole corn imports reached 3.1 million bushels over the same period. What is more striking is the origin of these imports. Of the organic cracked corn imported through February, 1.5 million bushels—or 55 percent—was sourced from Turkey. And in March 2018 alone, the U.S. imported an additional 2 million bushels of cracked corn, all of which was sourced from Turkey.

Although it may seem that importers could be attempting to avoid the scrutiny of procuring organic corn from the Black Sea region, there are other legitimate factors that could explain the increase in organic cracked corn imports. For one, U.S. organic poultry production has skyrocketed over the past two years, so leveraging imported cracked corn may simply be a way to meet rising poultry feed demand while minimizing costs. Another potential explanation for these increases could be the speculated expansion in organic corn milling capacity in the region. Even though the ramp-up in cracked corn imports appears phenomenal, it falls short of replacing the downturn in U.S. whole organic corn imports. Through February 2018, combined U.S. cracked and whole organic corn imports had reached 5.9 million bushels, down 43 percent from year-ago levels.

Although the role of imports in the U.S. organic corn market has declined, it remains significant. The shifting of organic corn supplies is worth keeping an eye on going forward. Mercaris will continue to watch the data currently available and plans to develop tools to look deeper into the cracked corn market’s less visible aspects.

Have you noticed any impacts from the recent uptick in organic cracked corn imports? What other implications do you think these imports will have on the US market?

Tweet us @mercaris or email us at mercaris@mercaris.com to let us know your thoughts!